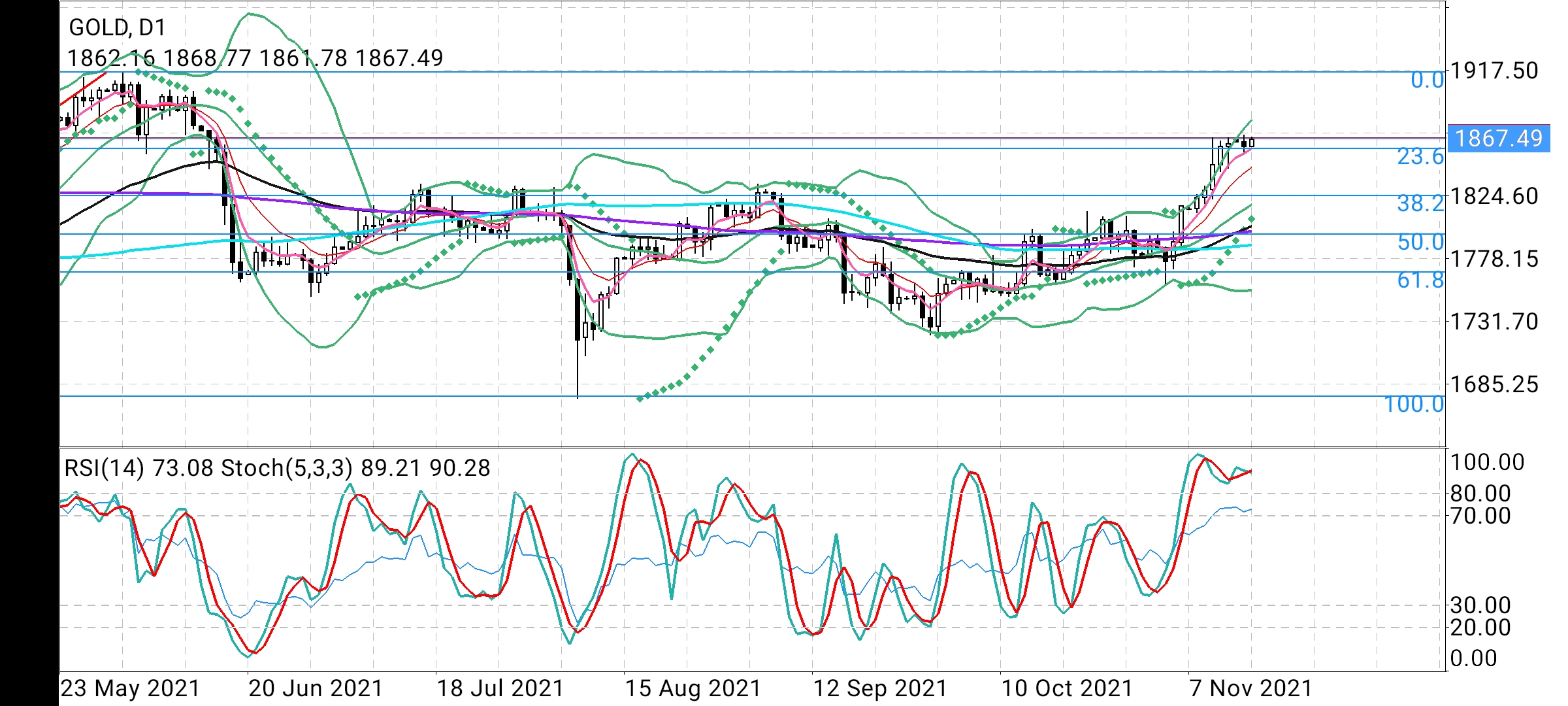

Gold has closed above 1860 for three days and a week close, 1860 is 23.6% fibonacci level which is a good affirmation for continuation towards path of least resistance 1900-1916 with small resistance at 1875-1880 enroute.

Given yesterday's bearish close, breaking below yesterday's low 1856 may prompt mild correction to 10 Day EMA 1846 and 38.2% fibonacci level 1825

However sustained move above 1860 and crossing above yesterday's high 1870 may extend the up move to 1881 on intraday basis while the bullish Breakout targets 1900-1916 in the short term.

Stochastic RSI is overbought in Daily and Weekly time frames which may cause some sideways action without hurting the uptrend.

There is hardly any critical resistance before 1900-1916 as long as Gold sustains above 1860