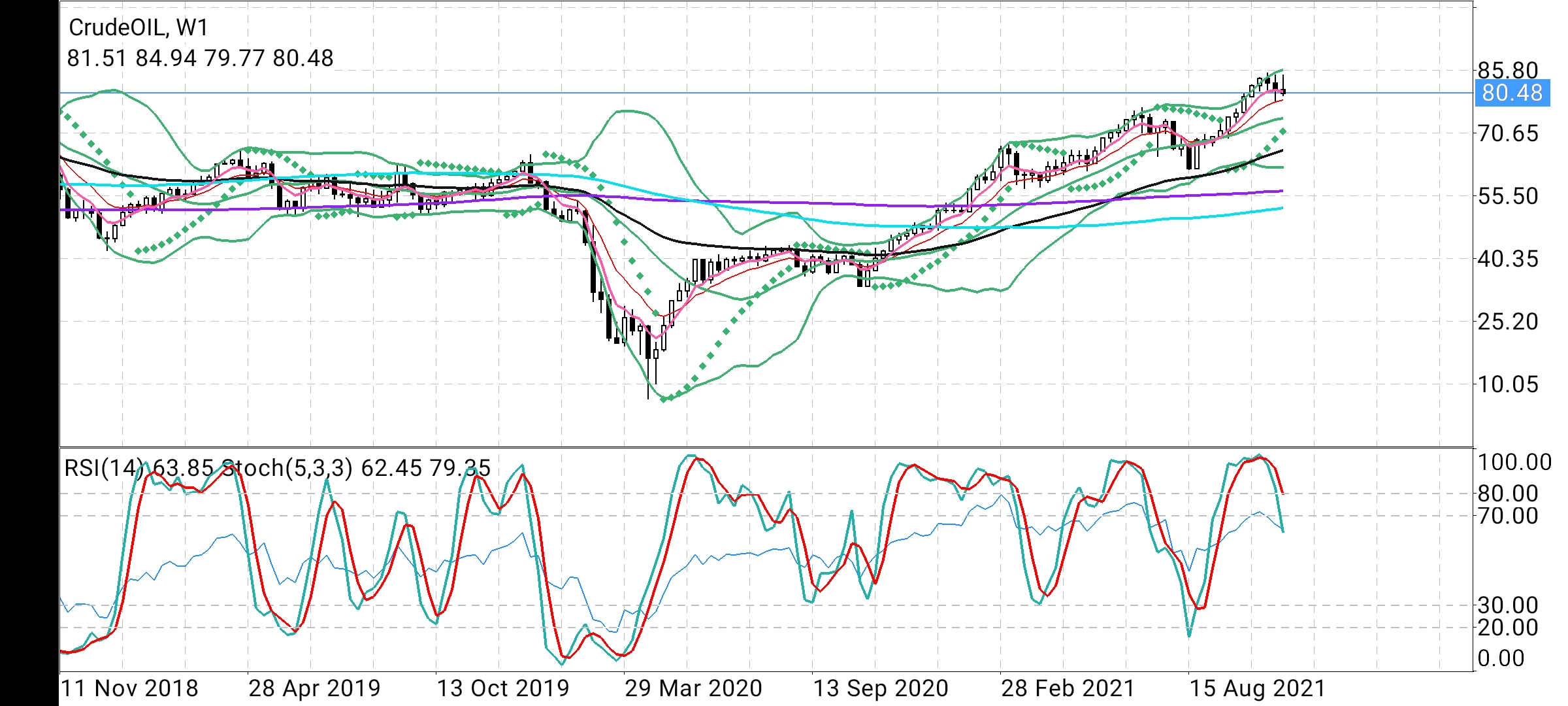

WTI Crude Oil formed Bearish Price Reversal Top when it closed the week (24th October at 82.97) ,below previous week's closing (17th October ) of 84.05

Subsequently, WTI Crude Oil closed 2nd week at 81.53 and now the current weekly candle trades at 80.28 below previous week's closing 81.53

This shows continuation of Bearish streak for 3rd week in a row.

If this 3rd week closes below 81.53 this may be a beginning of 3 Black Crows, a Bearish Technical formation, though it needs further confirmation by another week closing below 78 support.

Weekly candle (closed on 17th October) Stochastic had reached 97 making WTI overbought resulting in negative and bearish overlap.

Note: Stochastic on weekly chart is still above RSI and prices are still above the middle Bollinger Band which may trigger a bounce back in near term if 78 is not broken decisively.

WTI Crude Oil formed Bearish Price Reversal Top when it closed the week (24th October at 82.97) ,below previous week's closing (17th October ) of 84.05

Subsequently, WTI Crude Oil closed 2nd week at 81.53 and now the current weekly candle trades at 80.28 below previous week's closing 81.5

This shows continuation of Bearish streak for 3rd week in a row

If this 3rd week closes below 81.53 this may be a beginning of 3 Black Crows, a Bearish Technical formation, though it needs further confirmation by another week closing below 78 support

Weekly candle (closed on 17th October) Stochastic had reached 97 making WTI overbought resulting in negative and bearish overlap

Note: Stochastic on weekly chart is still above RSI and prices are still above the middle Bollinger Band which may trigger a bounce back in near term if 78 is not broken decisively.

#forextrading #forexsignals #WTIOIL #forex #bitcoin #crypto #bitcoinmining#forextrade #workfromhome #makemoneyonline